The 25-Second Trick For Irs 76001

Table of ContentsThe Of Tax Services Near MeNot known Facts About Arlington Tax ServicesIrs Tax Preparer Things To Know Before You BuyThe Ultimate Guide To Tax Office Near MeThings about Best Tax Services In Arlington TxThe Only Guide to Tax Services 76017

Numerous Americans pay a tax obligation expert to prepare and also submit their income tax return annually. As the number of taxpayers proceeds to grow, so does the need for certified tax obligation preparers who can help their clients assert all the credit scores as well as deductions due them and also pay no greater than taxes they owe.As soon as you have actually built count on as well as connection with your customers, it's easy to offer them these additional solutions that will aid bring in income year-round. This 319-page publication is your best guide to obtaining begun with a tax organization today! "One very vital point I have discovered over the years is that there is no requirement to reinvent the wheel.

Throughout this book, you will certainly find out many finest techniques that will certainly conserve you time and also money, and help you expand a successful tax company." Chuck Mc, Cabe, Creator, The Income Tax College.

More About Affordable Tax Service

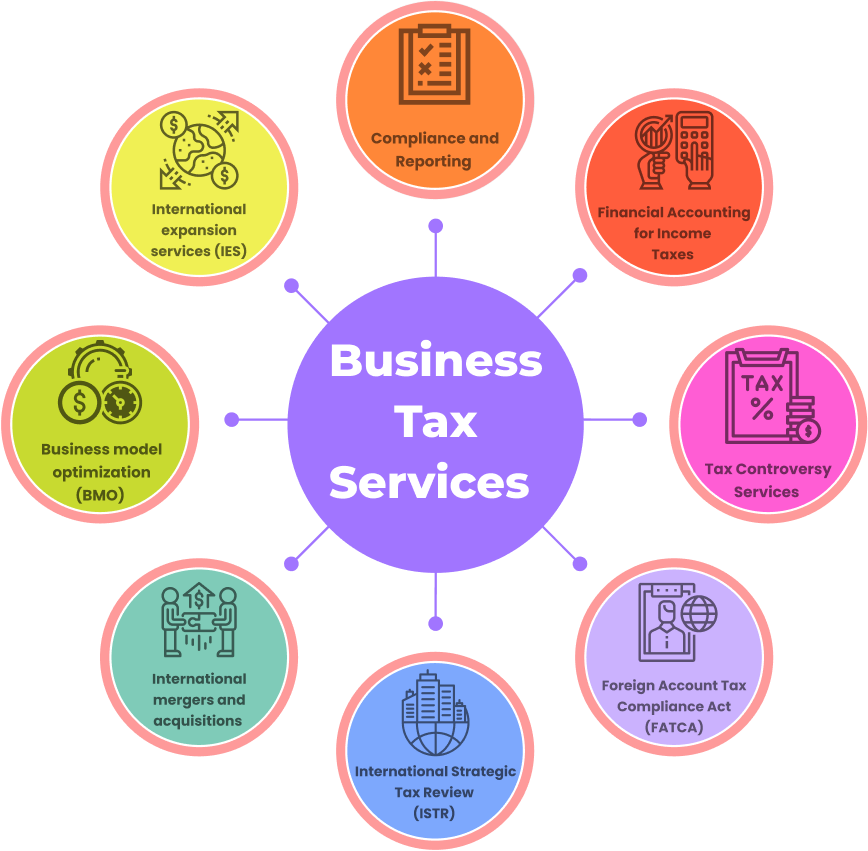

BDO experts supply a wide variety of fully integrated tax obligation solutions to customers all over the world.

Trainees used by UW must initially establish an account in a software application called Glacier Tax obligation Compliance when they are hired to work for the university. This is a than Glacier Tax Prep! If you currently have a Glacier Online Tax obligation Compliance account, you will certainly have the ability to gain access to Glacier Tax obligation Prep by experiencing that account.

The University of Washington does not give tax advice and therefore disclaims all responsibility from the misinterpretation or abuse of GTP. Tax professionals and certified tax obligation accountants, that charge for their services, can aid you with your tax obligations. Washington state does not have a state income tax obligation. If you worked in a state that has state revenue tax obligation, Glacier Tax Preparation (GTP) has a web link to an additional firm that will certainly calculate your state earnings tax.

An Unbiased View of Tax Services Near Me

The web link gets on the last web page of GTP after you complete all the questions for the federal tax return. If GTP figures out that you are a, please click the web link supplied by GTP and most likely to Free Documents: Do Your Federal Taxes for Free as well as pick a business - Best Tax Services in Arlington TX.

Glacier Tax Obligation Preparation, a tax software program, will certainly count just how lots of days you have actually remained in the U.S. and figure out if you are a resident or nonresident for tax obligation purposes. Please note that if you dealt with university you made use of, a protected, web-based application to establish the correct taxes on incomes for foreign national workers.

The 5-Minute Rule for Affordable Tax Service

ISS advisers are immigration experts and also are not enabled to provide tax obligation advice which is why we acquire Glacier Tax Prep to assist you with this process. If you have inquiries relating to exactly how to use the software, please go to the GTP Guide Video clips connect on the welcome web page of Glacier Tax obligation Prep.

The only method to get this cash returned to you is to file a revenue tax return. In this instance, you will require to pay the extra amount.

About Affordable Tax Service

That is why it is vital to file your tax obligations annually. Also if you did not work and also do not owe any kind of tax obligations, you may need to send an informative kind to the IRS. United state tax regulations can be complex and also confusingwe all get frustrations during tax seasonand the regulations that use to link worldwide students are not the exact same as those that put on united state

Before you begin the declaring procedure, be sure you have all the needed details with you. W-2 types are sent by mail to current as well as previous employees. This kind shows just how much you earned in 2015 and also just how much was secured for tax obligations. You will just get this kind if you have been utilized.

Affordable Tax Service Fundamentals Explained

The 1042-S type will just be offered to nonresident unusual students who have received scholarship or fellowship cash that goes beyond tuition and also relevant cost charges. You will certainly not obtain a copy of the 1042-S type if you only have a tuition waiver on your account and do not obtain any type of checks. IRS Tax Preparer.

These categories are for tax obligation objectives just as well as are not connected to your migration status. You might remain in F-1 or J-1 non-immigrant status as well as thought about a citizen for tax purposes. Nonresident aliens typically fulfill the significant visibility test if they have actually spent greater than 183 days in the U.S.Also if you pass the substantial existence examination, you could other still be taken into consideration a nonresident for tax objectives if you get approved for the Closer Connection Exemption to the Considerable Presence Test for Foreign Trainees. Your specific circumstance identifies which form(s) to submit. Types feature directions. If you got no united statehas income tax obligation treaties with various countries. Locals of these countries might be exhausted at a lowered rate or be exempt from united state earnings tax obligation withholding on specific type of U.S. resource revenue. Treaties differ amongst nations. If the treaty does not cover a specific kind of revenue, or if there is no treaty in between your nation and also the united state, you should pay tax on the revenue in the same way and at the same prices displayed in the directions for Type 1040NR.